Interest rates

To give an example a 5 annual interest rate with monthly compounding would result in an effective annual rate of 512. Interest rates represent the cost of borrowing money and are a percentage of the amount you borrow or save.

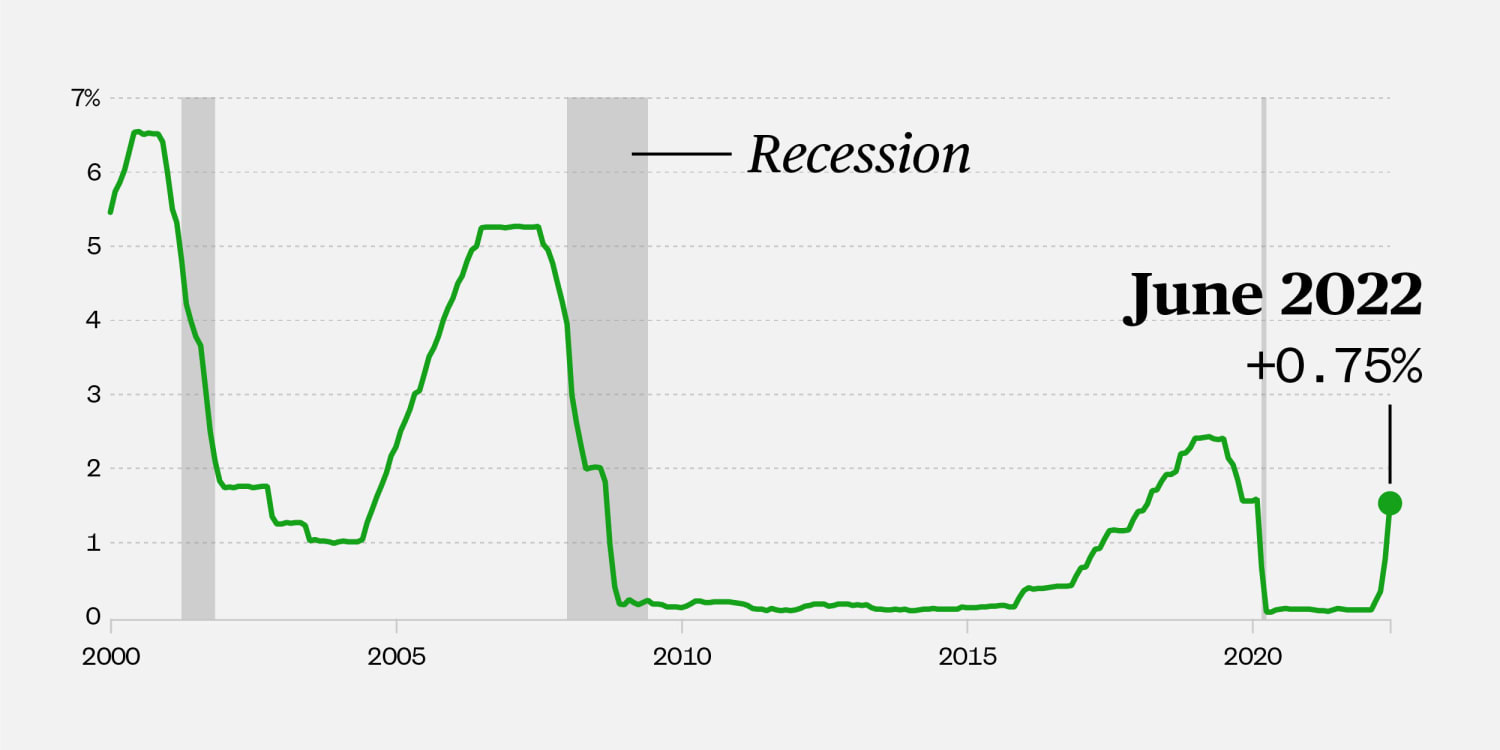

Fed Raises Key Interest Rate By 0 75 As It Hardens Fight Against Inflation

Interest is paid on either the monthly or annual anniversary of the account opening or the closest business day depending on the interest payment option chosen.

. The base rate is the interest rate the Bank of England charges when it lends money to other UK banks - so it acts as a benchmark for interest rates across the country. Interest rates have been raised for the sixth time in a row from 125 to 175. Our savings interest rates.

As a result they can speed up or slow down the economy. The Bank of Englands decision to increase rates by half a percentage point makes it the largest increase for 27. As a general.

So if you put 100 into a savings account with a 1 interest rate youd have 101 a year later. Our savings interest rates. The principal is the amount of money loaned.

Savings providers use this rate as a reference point for what theyll offer you through a savings account. The Federal Reserve manages interest rates to achieve ideal economic growth. B - non-interest bearing.

Tax-free means the interest you earn is exempt from UK Income Tax and Capital Gains. Interest rates currently stand at 125 but the central bank could increase them to as much as 175. Interest rates are shown as a percentage of the amount you borrow or save over a year.

A - interest bearing for 1 Matured 6-month and 18-month terms of Guaranteed Growth Bonds and Guaranteed Income Bonds Easy Access Savings Account Ordinary Account Deposit Bonds Yearly Plan SAYE Treasurers Account Pensioners Guaranteed Income Bonds Capital Bonds. If so that would be its highest level. London-based Patrick Reid owes thousands on credit cards and loans and fears an interest rate rise will cost him.

Interest rate Tax information. Current Bank Rate 125. Polls of economists and the view taken by the financial markets suggested UK interest rates were on course to rise from their current level of.

So if youre a borrower the interest rate is the amount you are charged for borrowing money shown as a percentage of the total amount of the loan. The total interest on an amount lent or borrowed depends on the principal sum the interest rate the compounding frequency and the length of time over which it is lent deposited or borrowed. Video on why interest rates matter.

This will open a PDF in a new window. Interest rates affect the cost of loans. Find interest rates in your area.

The interest rate on money you borrow is charged by the lender for the use of its money. Current rates effective 1st July 2022. Find out more and apply.

Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law. The above fixed rates apply to the Fixed Rate Cash ISA launched on 01062022 and are fixed until 30062023. The savings account term.

I have personal loans and credit cards totalling 25000 so any increase will be. An interest rate tells you how high the cost of borrowing is or high the rewards are for saving. The Bank of England base rate.

The higher the percentage the more you have to pay back for a loan of. Select your account from the list below to see your interest rate. The effective annual rate is the interest rate earned on a personal or business loan or investment over a time period with compounding factored in.

An interest rate is the amount of interest due per period as a proportion of the amount lent deposited or borrowed called the principal sum. AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest were paid and compounded once each year. Interest is what you pay for borrowing money and what banks pay you for saving money with them.

It can also be referred to as the annual equivalent rate AER. Since banks and building societies also borrow money from you in the form of money you put into a savings account they will also pay you an. An interest rate is the percentage of principal charged by the lender for the use of its money.

Everyday Saver PDF 813 KB. 30 June each year. The US central bank has just announced its biggest interest rate rise in nearly 30 years with the Federal Reserve increasing rates by three-quarters of a percentage point to a range of 15 to 175.

What Do Rising Interest Rates Mean For Your Money Access Wealth

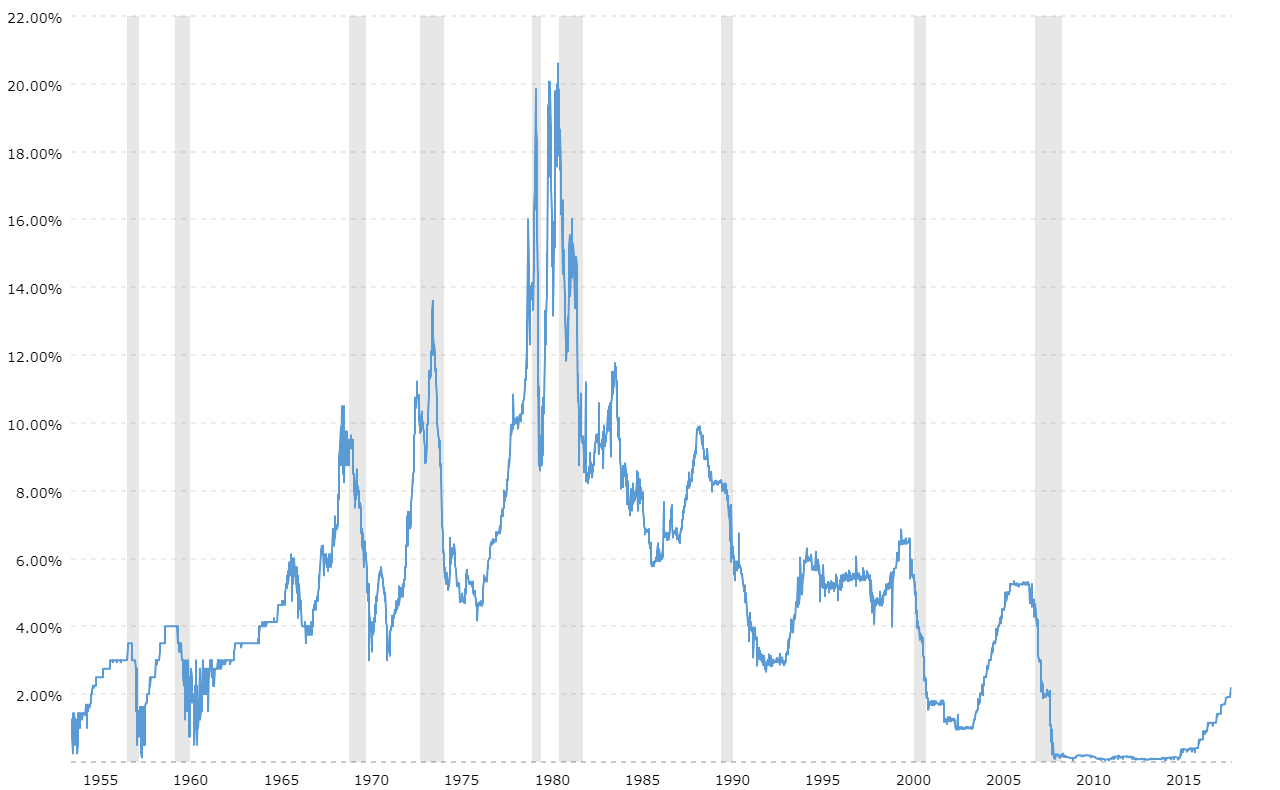

Making Sense Of The Interest Rate Evolution Planadviser

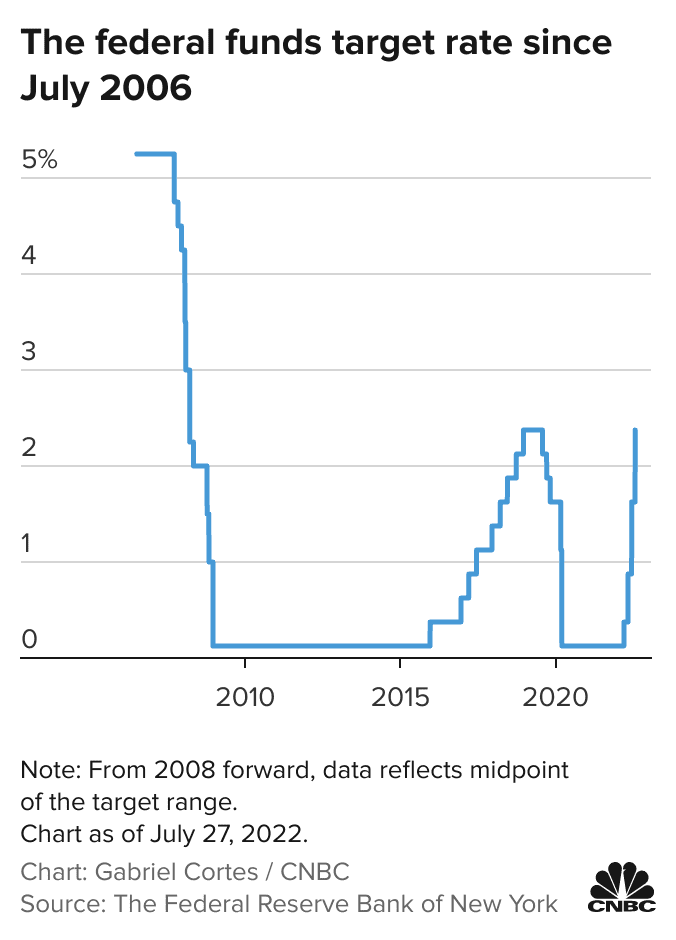

Federal Rate Hike Impacts Commercial Real Estate Mountain West

Federal Funds Rate 62 Year Historical Chart Macrotrends

Fed Fights Inflation With Another Big Rate Increase The New York Times

Fed Steps Up Inflation Fight Again But We See Rates Coming Down In 2023 Morningstar

United States Fed Funds Rate 2022 Data 1971 2021 Historical 2023 Forecast

Fed Decision July 2022 Fed Hikes Interest Rates By 0 75 Percentage Point

Comments

Post a Comment